The shift from fossil fuels to renewables isn’t just a technological revolution—it’s fundamentally reshaping how projects are financed, valued and operated. Article #7 of our clean‑energy deep dive explores the evolving economics, capital structures and business models that are driving renewables from niche to mainstream.

1. Rethinking Value: LCOE vs. System‑Value

Traditionally, project cost competitiveness has been judged by the Levelized Cost of Energy (LCOE)—the all‑in‑cost per megawatt‑hour (MWh) over a plant’s lifetime. LCOE remains a useful shorthand for comparing technologies (e.g., solar vs. wind vs. gas).

However, as variable renewables grow, grid operators now value energy not only for its price but also for its timing, flexibility and grid‑stabilizing attributes. System‑value approaches incorporate capacity credits (the reliability contribution of a generator), ancillary‑service revenues (frequency control, reserves), and integration costs (curtailment, backup). Clean‑energy developers must therefore optimize both LCOE and system value—balancing low‑cost generation with strategic siting, storage pairing and hybridization to capture additional revenue streams.

2. Project Finance & PPA Markets

The backbone of utility‑scale renewables financing remains non‑recourse project finance. Lenders and investors underwrite a stand‑alone SPV (special purpose vehicle) based on long‑term contracted cash flows, with limited recourse to sponsors. Key elements include:

- Power Purchase Agreements (PPAs): 10–25 year offtake contracts with utilities, corporates or aggregators that lock in a fixed or indexed price. These stabilize cash flows and improve bankability.

- Merchant Risk: In deregulated markets, some projects elect merchant exposure, selling power at spot prices. Merchant risk can yield higher returns in bullish markets but demands hedging strategies (e.g., financial swaps, swing options) to protect downside.

- Tax Equity & Subsidies: In jurisdictions like the U.S., tax‑equity investors monetize production tax credits (PTC) or investment tax credits (ITC), accelerating sponsor IRR. In Europe and Asia, feed‑in tariffs (FiTs) or auctions de‑risk early cash flows.

3. Innovative Capital Structures

Beyond traditional debt + equity, new financing vehicles are emerging to unlock liquidity and spread risk:

- Green Bonds: Issued by corporates, project developers or municipalities, green bonds channel fixed‑income investors into climate‑friendly projects. Transparency and alignment with standards (e.g., ICMA Green Bond Principles) are key to commanding pricing premiums.

- Yieldcos: Publicly listed vehicles that aggregate operating clean‑energy assets, offering shareholders stable dividend yields. Yieldcos allow sponsors to recycle capital—develop new projects, then “drop down” stabilized assets to the yieldco.

- Infrastructure Funds & Sovereign Wealth: Pension funds, insurers and SWFs are increasingly allocating to renewables for long‑duration, inflation‑linked cash flows. Their entry has driven down cost of capital but raised competition for prime assets.

4. Corporate PPAs & Off‑takers

Corporates seeking to decarbonize procurement are signing direct PPAs, spurring a multi‑gigawatt market outside of utility offtake. Two main models prevail:

- Physical PPAs: The buyer takes title to electrons; contracts often paired with virtual trading to settle location mismatch.

- Virtual (Financial) PPAs: A purely financial hedge where the generator sells into the wholesale market, and the corporate pays/receives the difference between a fixed strike price and the market price.

These offtake agreements provide developers with credit‑worthy counterparties and allow corporates to claim renewable energy certificates (RECs) for sustainability reporting.

5. Emerging Business Models & Digital Platforms

Digitization is spawning new models that blur the line between producer, consumer and prosumer:

- Community Energy Cooperatives: Neighbors co‑invest in local solar or wind assets, share revenues and foster social license.

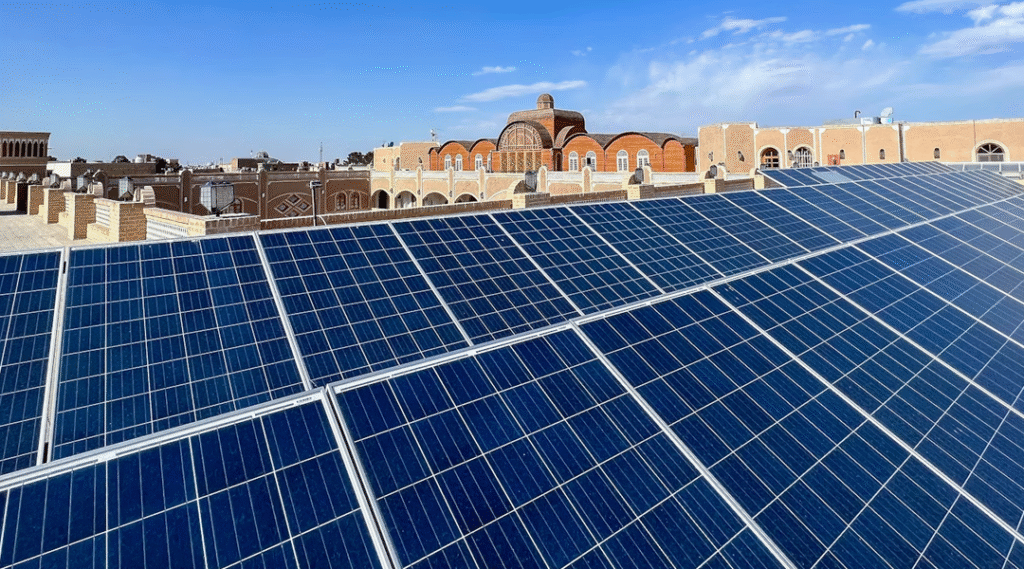

- Energy‑as‑a‑Service (EaaS): Third‑party providers finance, build and operate behind‑the‑meter systems (e.g., rooftop solar + storage), charging customers a subscription for energy services rather than equipment.

- Peer‑to‑Peer Trading: Blockchain‑enabled marketplaces let prosumers trade excess solar with local buyers, improving utilization and grid resilience.

6. Strategies to Win the Finance Game

- Diversify Revenue Stacks: Pair renewables with storage, demand‑response or hybrid generation to tap capacity, ancillary and merchant markets.

- Optimize Capital Mix: Blend concessional finance (multilateral loans, green bonds) with commercial debt and equity to minimize WACC.

- Leverage Data & Digital Tools: Use predictive analytics to improve O&M, reduce downtime and enhance asset valuations.

- Forge Strategic Partnerships: Align with corporates for PPAs, municipalities for community projects, and fintechs for innovative customer offerings.

Clean‑energy economics and financing continue to evolve at breakneck speed. By mastering LCOE and system‑value trade‑offs, adopting novel capital structures and embracing digital business models, project developers and investors can secure sustainable returns while accelerating the green transition.

All articles for this special edition-Clean Energy:

(#1) The State of the Global Clean Energy Transition

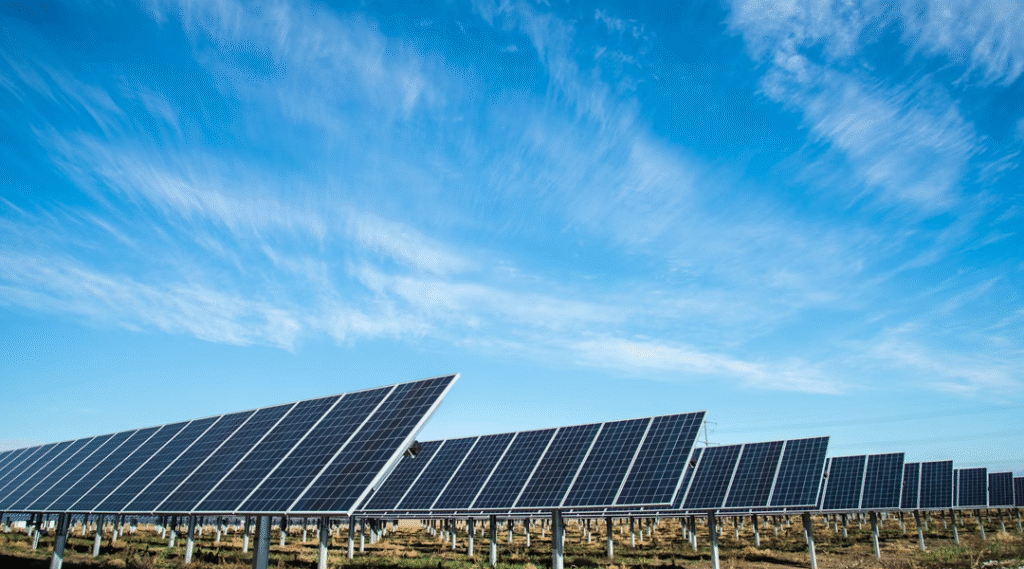

(#2) Solar Power: Illuminating the Path from Rooftops to Utility-Scale Farms

(#3) Wind Energy: Onshore, Offshore & Beyond

(#4) Harnessing the Depths and Tides: A Deep Dive into Hydro, Marine & Geothermal Energy

(#5) Bioenergy & Waste‑to‑Energy: Turning Organic Residues into Renewable Power

(#6) Energy Storage & Grid Integration: Powering the Future of Clean Energy

(#7) Economics, Financing & Business Models in the Clean‑Energy Transition

(#8) Designing the Rules: Policy, Regulation, and Market Design in the Clean‑Energy Era

(#9) Environmental & Social Impacts of the Clean‑Energy Transition

(#10) Next‑Generation Clean‑Energy Innovations & the Road Ahead

As for in-depth insight articles about AI tech, please visit our AI Tech Category here.

As for in-depth insight articles about Auto Tech, please visit our Auto Tech Category here.

As for in-depth insight articles about Smart IoT, please visit our Smart IoT Category here.

As for in-depth insight articles about Energy, please visit our Energy Category here.

If you want to save time for high-quality reading, please visit our Editors’ Pick here.