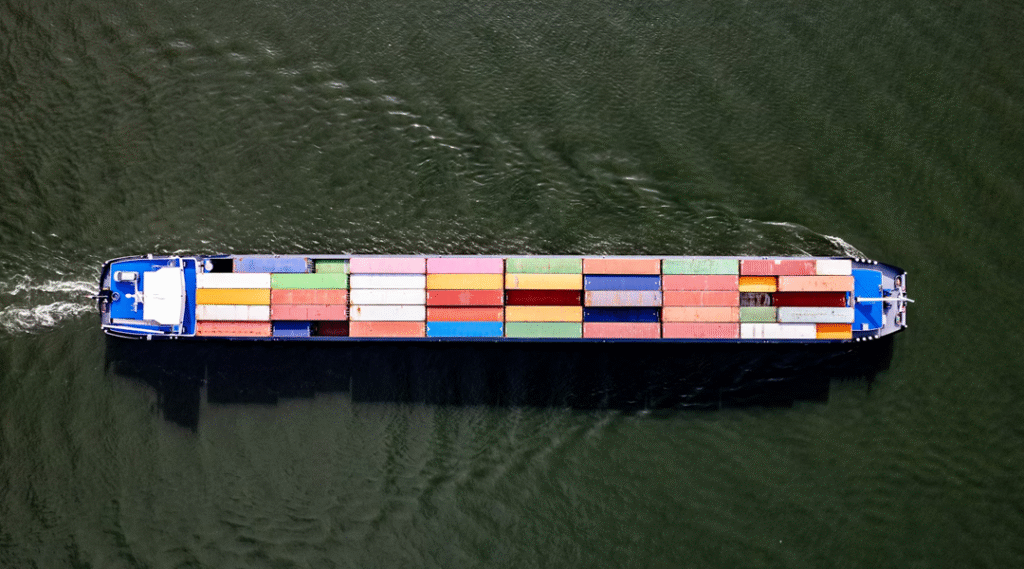

The automotive aftermarket’s supply chain and logistics network is a complex web that underpins the timely delivery of parts and services to millions of vehicles worldwide. From sourcing raw materials to delivering replacement components to repair facilities and retail outlets, every step presents unique challenges that can impact cost, availability, and customer satisfaction. In this deep dive, we explore the key pain points in the aftermarket supply chain and logistics landscape, examine strategies for resilience, and highlight best practices that leading players are deploying to keep vehicles—and profits—on the road.

1. Sourcing Strategies: Balancing OEM, Refurbished, and Remanufactured Parts

A foundational decision for aftermarket suppliers is which types of parts to source and promote. Original Equipment Manufacturer (OEM)-equivalent parts offer quality assurance but often come at higher costs and longer lead times. Refurbished and remanufactured components, by contrast, can deliver cost savings and sustainability benefits, but they carry greater risk of variability in performance and lifespan.

- OEM-Equivalent Parts: Preferred by professional repair shops and dealers who demand consistent quality and warranties. However, reliance on a limited set of tier‑one suppliers can introduce single‑source vulnerabilities—if a manufacturer’s plant experiences downtime, entire product lines may be delayed.

- Refurbished & Remanufactured: Provide a circular economy approach by rebuilding used cores. Remanufacturers often face logistical hurdles in collecting, inspecting, and reconditioning cores, requiring tight coordination between collection programs and rebuild facilities.

Striking the right mix requires advanced demand forecasting, agile supplier relationships, and risk-sharing agreements that incentivize volume flexibility and quality compliance.

2. Warehousing Footprint and Inventory Management

Effective warehousing is more than square footage—it’s about positioning the right inventory, at the right density, in the right locations:

- Decentralized Regional Hubs: Many leading distributors operate multiple regional warehouses to reduce transit time and last‑mile costs. While this cuts delivery times, it raises overall inventory carrying costs and increases complexity in stock balancing.

- Centralized Mega‑Hubs: Central hubs benefit from economies of scale in storage and handling but risk longer transit times, especially for expedited orders.

- Inventory Optimization: Advanced analytics platforms enable dynamic stocking rules—such as min/max levels based on historical demand, lead‑time variability, and seasonality. Companies like LKQ and Advance Auto Parts leverage AI-driven demand forecasting to trim safety stock by 15–20% without sacrificing fill rates.

Best‑in‑class operations adopt a hybrid model: regional buffer stock for high‑velocity SKUs, paired with centralized bulk for slower‑moving items, dynamically rebalanced through automated inventory management systems.

3. Drop‑Shipping and Digital Order Fulfillment

E‑commerce’s rise has fueled interest in drop‑shipping models, where suppliers deliver directly to consumers or independent repair shops:

- Drop‑Shipping Pros: Reduced warehousing costs and capital tied up in inventory; faster time to purchase as orders ship straight from supplier or manufacturer.

- Drop‑Shipping Cons: Loss of control over packaging, shipping quality, and returns handling; potential confusion for end customers if multiple drop‑shippers are involved.

To mitigate these risks, digital platforms are integrating real‑time order tracking, automated customer notifications, and unified returns portals that maintain a single “brand experience” even when multiple suppliers fulfill items.

4. Last‑Mile Delivery: Speed Versus Cost

The final leg—last‑mile delivery—often accounts for up to 30% of total logistics expenses. In the automotive aftermarket, customers demand rapid turnaround: a busy repair shop can experience significant downtime if a critical part is delayed.

- Express Networks: Partnerships with couriers offering same‑day or next‑day delivery in metro areas. Premium service comes at a premium price, so it’s typically reserved for high‑value, urgent SKUs (e.g., engine control modules, ABS pumps).

- Consolidated Shipments: Grouping multiple orders into a single delivery run reduces costs but increases lead time. This approach suits non‑urgent consumables like filters and wipers.

- Click‑and‑Collect: Leveraging retail footprints (for chains like AutoZone or O’Reilly), where parts can be ordered online and picked up locally, combining convenience with cost efficiency.

Optimizing the last mile involves segmenting SKUs by urgency and value, then routing orders through the most appropriate delivery service—balancing cost, speed, and reliability.

5. Risk Mitigation: Managing Disruption and Obsolescence

Geopolitical tensions, natural disasters, and pandemics have underscored the need for resilient supply chains:

- Multi‑Sourcing: Establishing agreements with multiple suppliers across different regions to avoid single‑point failures. This can include dual-sourcing critical chips used in modern electronic modules.

- Flexible Manufacturing: Contract manufacturers equipped to shift production lines between part families, enabling rapid response to demand spikes or supplier outages.

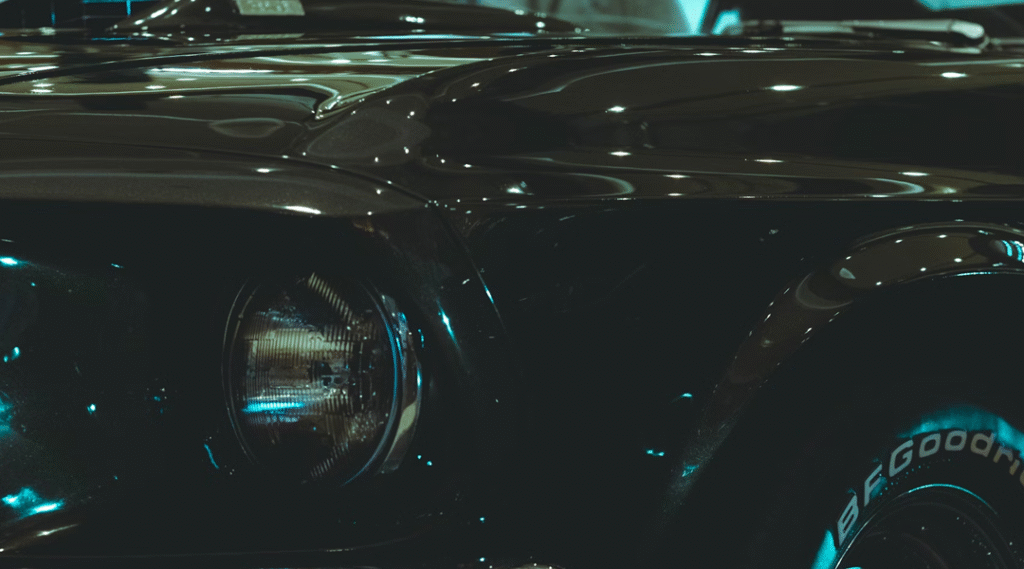

- Obsolescence Management: For older vehicles where parts become scarce, aftermarket firms maintain legacy parts programs or partner with remanufacturers to reproduce discontinued items, preserving revenue streams from older model repairs.

Proactive risk assessments, scenario planning, and regular supplier audits are essential tools for anticipating and responding to supply chain shocks.

6. Technology Enablement: Digital Twins and Blockchain

Emerging technologies offer new levers to enhance transparency and traceability:

- Digital Twins: Virtual replicas of warehouse operations simulate inventory flows, identify bottlenecks, and test process changes without disrupting live operations.

- Blockchain Tracking: Immutable records of parts’ provenance and movement provide end‑to‑end visibility—crucial for high‑value components and regulatory compliance in safety‑critical systems.

Early adopters are piloting these solutions to streamline verification, reduce counterfeit risks, and strengthen stakeholder trust.

Final Thoughts

Supply chain and logistics excellence in the automotive aftermarket demands a holistic approach: strategic sourcing, intelligent warehousing, seamless order fulfillment, resilient risk management, and forward‑looking technology adoption. By embracing hybrid inventory models, flexible fulfillment strategies, and advanced analytics, aftermarket leaders can not only weather disruptions but gain competitive advantage through superior service levels and operational efficiency. In a market where vehicle uptime is paramount, supply chain mastery will continue to differentiate winners and laggards in the road ahead.

All articles for this special edition-Automotive Aftermarket (Auto):

(#1) Latest Market Size and Growth Dynamics of the Global Automotive Aftermarket

(#2) Deep Analyses of Distribution & Channel Landscape of the Automotive Aftermarket

(#3) Decoding Consumer Behavior and Buying Journeys in the Automotive Aftermarket

(#4) Deep Analyses of Parts & Service Segmentation in the Automotive Aftermarket

(#5) Driving the Future: Technology and Digital Transformation in the Automotive Aftermarket

(#6) The Analyses of Regulatory, Safety, and Compliance Landscape in the Automotive Aftermarket

(#7) The Automotive Aftermarket: Competitive Dynamics and M&A Trends

(#8) Supply Chain & Logistics Challenges in the Automotive Aftermarket

(#9) Emerging Trends & Innovation in the Automotive Aftermarket

(#10) Future Outlook & Strategic Imperatives for the Automotive Aftermarket

As for in-depth insight articles about AI tech, please visit our AI Tech Category here.

As for in-depth insight articles about Auto Tech, please visit our Auto Tech Category here.

As for in-depth insight articles about Smart IoT, please visit our Smart IoT Category here.

As for in-depth insight articles about Energy, please visit our Energy Category here.

If you want to save time for high-quality reading, please visit our Editors’ Pick here.