The global energy system is undergoing a profound shift away from fossil fuels toward low‑carbon sources. While record‑setting renewable deployments and cost declines signal real momentum, the pace must accelerate dramatically to meet 2030 and 2050 climate targets. This article explores today’s energy mix, the ambitions on the horizon, the forces driving change, investment trends, remaining gaps, and the roadmap ahead.

1. Today’s Energy Mix

Despite rapid renewable growth, fossil fuels still supply the lion’s share of our power and heat. In 2023, oil, coal, and natural gas together accounted for roughly four‑fifths of total primary energy consumption, while wind, solar, hydro, bioenergy, and geothermal made up the remaining fifth. In the electricity sector—in which decarbonization efforts have been strongest—renewables contributed about 30% of generation, with hydropower leading, followed by wind and solar. These figures represent significant progress compared to a decade ago but underscore how far the world must go to fully decarbonize.

2. Ambitious Targets for 2030 and 2050

International and national frameworks have set the bar high:

- 2030 Capacity Goals: Nations committed at COP28 to triple global renewable capacity—from around 4,000 GW today to over 11,000 GW—within the next seven years.

- Mid‑decade Power Mix: Analysts forecast renewables rising to roughly 35% of global electricity generation by 2025, enough to flatten power‑sector emissions.

- Net Zero by 2050: Aligning with a 1.5 °C pathway demands near‑complete phase‑out of unabated coal, oil, and gas, alongside massive scale‑ups of clean power, electrification, and efficiency across transport, industry, and buildings.

Meeting these milestones requires sustained acceleration well beyond current trends.

3. Key Drivers of Change

Several interlocking forces are propelling the transition:

- Climate Commitments: The Paris Agreement and subsequent COP summits have galvanized national policies, emissions‑trading schemes, and renewables mandates.

- Corporate Ambition: Thousands of companies now pledge net‑zero targets, spurring investment in clean energy, energy efficiency, and low‑carbon fuels across their operations and supply chains.

- Technology Cost Declines: Solar photovoltaic costs have dropped by more than 80% over the past decade, and onshore wind and lithium‑ion batteries have seen similar reductions—making clean technologies the cheapest option in many markets.

- Policy Incentives: Feed‑in tariffs, tax credits, auctions, and carbon pricing mechanisms continue to de‑risk projects and unlock capital at scale.

4. Capital Flows and Investment Trends

Robust financing underpins any successful energy transition:

- Global Investment: In 2023, around USD 2.8 trillion was invested in the energy sector, with roughly 60% directed toward renewables, grids, storage, and low‑carbon fuels—outpacing fossil‑fuel spending for the first time.

- Clean‑Energy Surge: Low‑carbon energy investment climbed by nearly 20% year‑over‑year, led by solar, wind, and battery projects. China, Europe, and the United States accounted for the majority of new commitments.

- Funding Gap: To stay on a 1.5 °C pathway, annual clean‑energy investment must roughly double—to about USD 4–5 trillion—by the end of the decade.

5. Bridging the Deployment Gap

Despite record growth, the current trajectory falls short:

- Capacity Additions Needed: The world added nearly 500 GW of renewables in 2023—a 35% increase over the prior year—but must average more than 1,000 GW per year through 2030 to hit stated targets.

- Infrastructure Bottlenecks: Upgrading and expanding transmission networks, accelerating permitting processes, and unlocking financing in emerging economies are critical to avoid becoming the new rate‑limiting steps.

6. The Road Ahead

Closing the gap between ambition and reality will require concerted action from governments, investors, and industry:

- Scale Financing: Ramp public and private investment to USD 4–5 trillion annually by 2030, using innovative instruments like green bonds, blended finance, and outcome‑based subsidies.

- Modernize Grids: Implement smart‑grid technologies, digital controls, and regional interconnections to integrate higher shares of variable renewables while maintaining reliability.

- Advance Innovation: Accelerate commercialization of long‑duration storage, green hydrogen, carbon capture, and next‑generation nuclear to address hard‑to‑abate sectors.

- Ensure Equity: Direct finance and technology to developing regions to support a just transition, prevent stranded assets, and foster inclusive economic growth.

By aligning policy, finance, technology, and equity considerations, the global energy system can complete its pivot from fossil dominance to a resilient, net‑zero future—securing both climate stability and sustainable prosperity.

All articles for this special edition-Clean Energy:

(#1) The State of the Global Clean Energy Transition

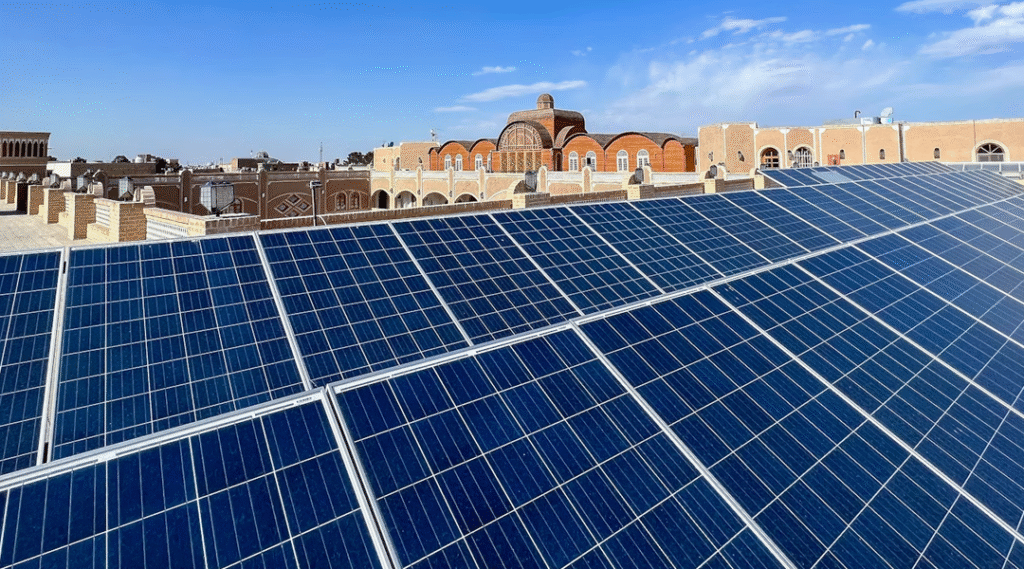

(#2) Solar Power: Illuminating the Path from Rooftops to Utility-Scale Farms

(#3) Wind Energy: Onshore, Offshore & Beyond

(#4) Harnessing the Depths and Tides: A Deep Dive into Hydro, Marine & Geothermal Energy

(#5) Bioenergy & Waste‑to‑Energy: Turning Organic Residues into Renewable Power

(#6) Energy Storage & Grid Integration: Powering the Future of Clean Energy

(#7) Economics, Financing & Business Models in the Clean‑Energy Transition

(#8) Designing the Rules: Policy, Regulation, and Market Design in the Clean‑Energy Era

(#9) Environmental & Social Impacts of the Clean‑Energy Transition

(#10) Next‑Generation Clean‑Energy Innovations & the Road Ahead

As for in-depth insight articles about AI tech, please visit our AI Tech Category here.

As for in-depth insight articles about Auto Tech, please visit our Auto Tech Category here.

As for in-depth insight articles about Smart IoT, please visit our Smart IoT Category here.

As for in-depth insight articles about Energy, please visit our Energy Category here.

If you want to save time for high-quality reading, please visit our Editors’ Pick here.